Plume Deliveries is a fictional name given to a leading distributor that uses B2B Open Banking.

Plume Deliveries is a forward-thinking and innovative brand that runs as cost efficiently as possible, so the prospect of reducing the external costs associated with processing card transactions was bound to appeal. With B2B Open Banking, the processing fees are cheaper than traditional payment methods, therefore increasing the profit margin of transactions – making it a no-brainer for Plume Deliveries to adopt because it was going to save them thousands each month.

Once an agreement had been reached, Plume Deliveries were ready to start using B2B Open Banking within a week, so they had the capability to start offering the service to customers incredibly quickly. The next task was for Plume Deliveries’ customers to start using open banking to pay rather than previous payment methods, with the distributor achieving more than £10,000 in savings in the first month after shifting 50% of its customer base in that time.

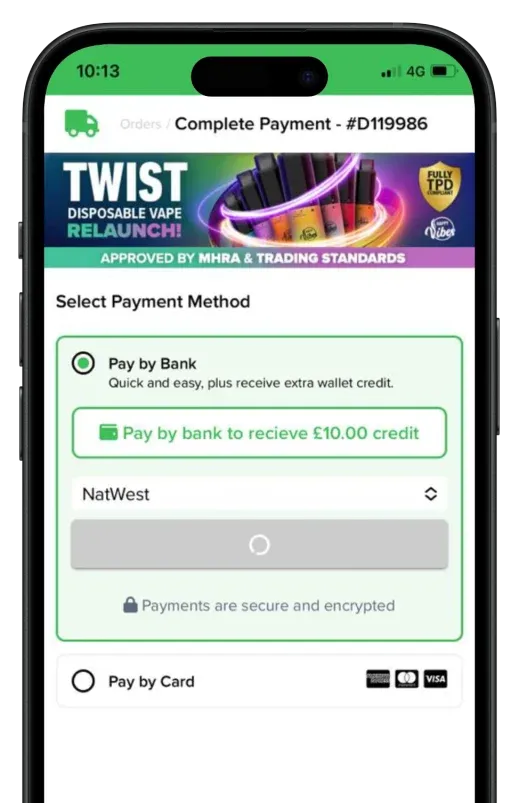

The secret to Plume Deliveries’ success was to incentivise their customers to try out open banking. The majority of orders were made online, so the first step was to add open banking to their payment page for customers to see, but that wasn’t enough to encourage customers to change their payment method. As the alternative was paying card-acquisition charges to the bank, they added a money-off incentive for those people who paid using open banking in order to get their customers hooked. It was a simple promotion to run and they reaped the rewards.

Initially, yes. Our recommendation is that any company newly offering open banking to customers includes an incentive to try out the new payment method. The challenge otherwise is to encourage people to change existing habits for no reason that benefits them, which isn’t a common behaviour. Plume Deliveries could see the benefit of continuing to make savings and have retained the incentive ever since.

Since launching B2B Open Banking, Plume Deliveries has made significant savings in card transaction fees. With a month-high total of £2.7 million going through Plume Deliveries’ open banking, the company is saving thousands that would previously have been paid to process transactions – and with more than 4,000 customers consistently paying with the method, it’s clearly popular. The monthly values continue to grow, so that figure is expected to increase even more in the future.

Encourage customers to try the new method by rewarding them

Make sure customers understand what open banking is

Identify where most payments are made to target pain points