They introduced B2B Open Banking into their business as a new way for their customers to make payments. The idea was to encourage more customers to use open banking instead of paying with cash or by card, therefore reducing the amount of fees they pay to process those transactions.

They used a few different methods to encourage customers to use open banking and had some success with each one. The first way was to put a QR code on their invoices, statements and order confirmations, so every customers who gets a delivery on the van can simply scan it and pay – they found it quite a simple way to get the message across.

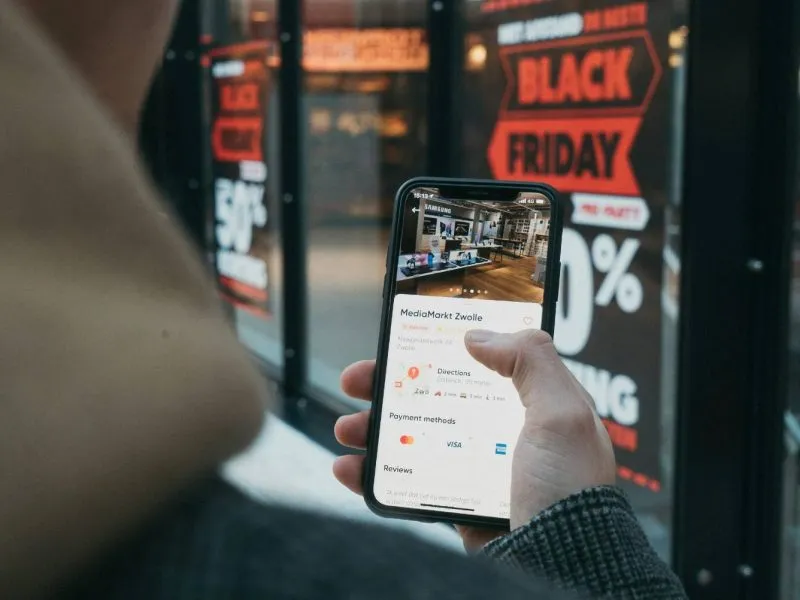

They also promoted open banking using the banner and pop-up ads on their eCommerce site. They included an offer on the banner to incentivise use, so anyone using open banking for the first time gets a free case of water.

Whilst they didn’t have much feedback from their customers, they considered that to be a good sign. They did have one customer who thought the idea of scanning a QR code and paying there and then was great. They customer was about to get some cash to pay when he was told about open banking and he said ‘that’s brilliant, just what I need’.

Yes, it seems that once people have used open banking once and seen how easy it is to use, they continue to use it. The mindset thing is important because you’ve got to change someone’s habit from the way they’ve always paid to do it with open banking, but we’re hoping it’s going to become like second nature for a lot of customers.

We’re taking less cash and have said to our customers that used to give us money upon delivery that we’re no longer going to take that, which is a lot safer for our drivers. If we had one guy on the van and doing several drop offs, he could come back with a couple of grand on him by the end of the day, which wasn’t ideal for his safety or for insurance purposes.

It’s like any new technology, it does take some time for it to be adopted, but the numbers are increasing and within a few months we’re already getting a fair amount of transactions coming through via open banking. It takes some people time to get on board, but there’s no doubt it’s being taken up more and more. It’s like anything, though, that as more people use it and can see the benefit, they’ll come to like it.

Create a bespoke QR code to make it easy for customers to scan and pay

Promote offers to encourage customers to try open banking

Spread the word about open banking when talking to customers