Introducing the new payment service helped to reduce costs within only a few weeks

There’s no denying it, we’re all feeling the pinch right now. With a cost-of-living crisis in full force that’s battering homes and businesses across the UK and very little sign of it abating any time soon, finances are never far away from any of our minds.

For wholesalers, it’s been a particularly rocky few years, with Covid-19, driver and stock shortages, and now a serious squeeze on the country’s economic freedom, with scant support out there to negotiate a way through it. They’ve had no other choice but to dig in, innovate and find another raft of solutions to keep business moving.

Often that can lead wholesalers to our door, as they look to strip costs from their operations or bring in new revenue streams – and, as a result, our B2B Open Banking service has grown in popularity as a genuine cost saver.

Our version of the hot new payment method can be integrated into a business for free, so wholesalers are seeing a clear route to making savings by converting customers from paying with credit and debit cards (and the relatively high transaction costs associated with them) to using open banking.

Of those wholesalers that have already adopted the technology, there have been some startling results. Among them, the standout example is a wholesaler that managed to shift 50% of its customer base over to open banking within a month – saving north of £10,000 in the first few weeks alone.

The secret to their success was to incentivise their customers to try out open banking. Since the alternative was paying card-acquisition charges to the banks, they had no qualms with passing the first round of savings on with the hope that it would get their customers hooked. It was a simple promotion to set up and they reaped the rewards with super-quick adoption across the board.

Their approach worked and the convenience of paying with open banking encouraged customers to keep using it. Incentive or not, that’s the trend we’re seeing across the board: once customers turn to open banking, they rarely go back again. It makes for a highly effective way of cutting costs quickly and keeping them down.

How much will I save with open banking?

Obviously, with a service like B2B Open Banking, the money shot is getting as many customers as possible to change the way they pay, and easiest route to doing that is offering the option to use it at as many payment points around your business as possible.

For the uninitiated, that can seem like a daunting task. Thankfully, having worked on open banking projects with several wholesalers of different shapes and sizes, we’ve got a great idea of what best practice looks like, so offer free consultancy to any new customers to get things moving.

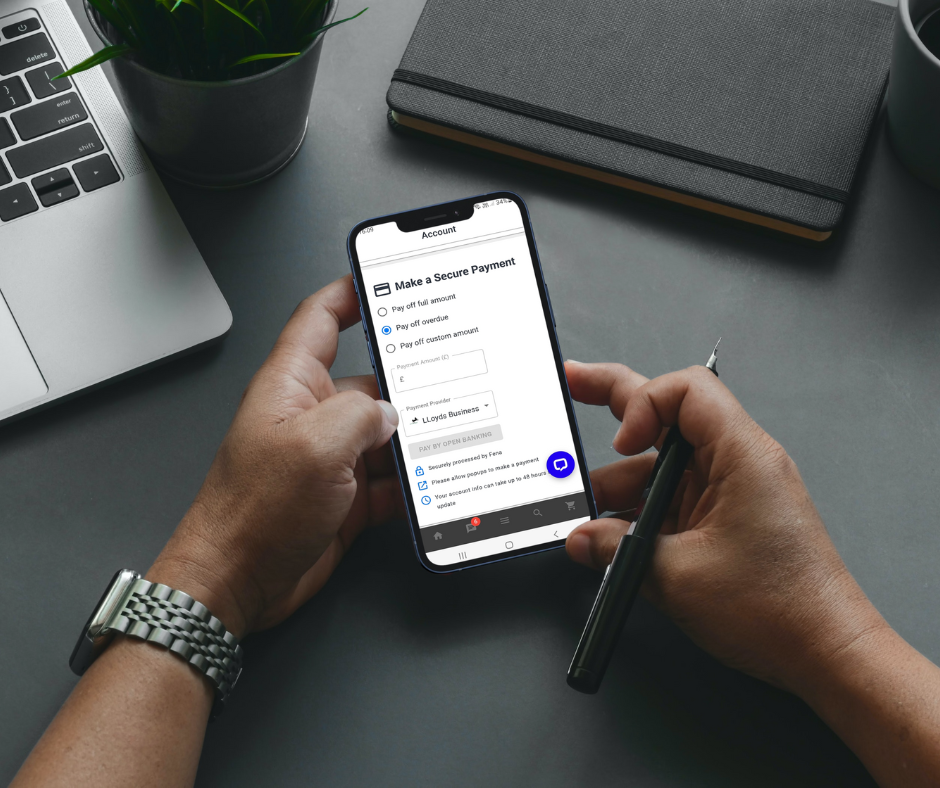

We’ve also come up with several secure methods to use B2B Open Banking across a wholesaler’s business, whether that’s as part of the automated credit control process, in-depot, on your website, at the point of delivery, by your telesales team or out on the road with your delivery drivers or sales reps. The journey may be slightly different each time, but the end result is always a simple transaction, essentially a bank transfer using a banking app.

As a result, the amount a wholesaler will save with open banking does differ. It depends on their relative size and how much their annual card acquisition charges are (they’re likely to be pretty high), as well as how quickly they can get customers moved on to open banking. But there’s gold in them thar hills if businesses get it right.

How much does B2B Open Banking cost?

For a start, there is no upfront cost to using open banking with us. It’s all based on the actual transactions that go through the business, as we take a small percentage of each payment – a bit like the banks do now with credit and debit cards, but significantly lower.

It means that if no one uses open banking to pay your business, you spend nothing. Conversely, you’ll be saving thousands on card transaction fees before we send you an invoice for what’s been used. And with no integration necessary to get started, there are really no hurdles to using B2B Open Banking in very little time at all.

Find out more about B2B Open Banking on our solutions page.